triple bottom stocks meaning

Its a sign the buyers are coming in the market to avoid the security. It consists of three valleys or support levels.

I M Not Sold On Salesforce Com Stock Realmoney

The Triple Bottom is one of the technical formations that indicates a bullish outlook for the stock commodity index.

. The Triple Bottom Line in business. Triple Bottom is helpful to identify bearish stocks stock that have been trading weak. Now not every triple bottom is going to lead.

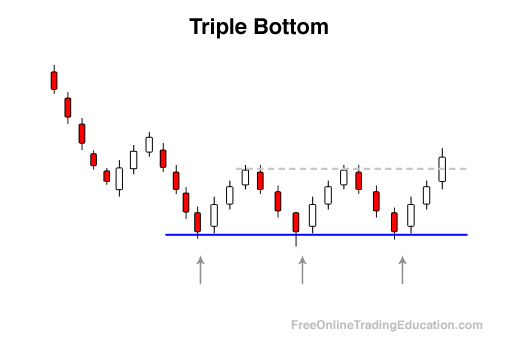

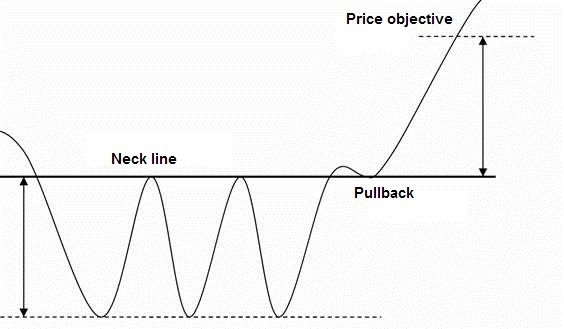

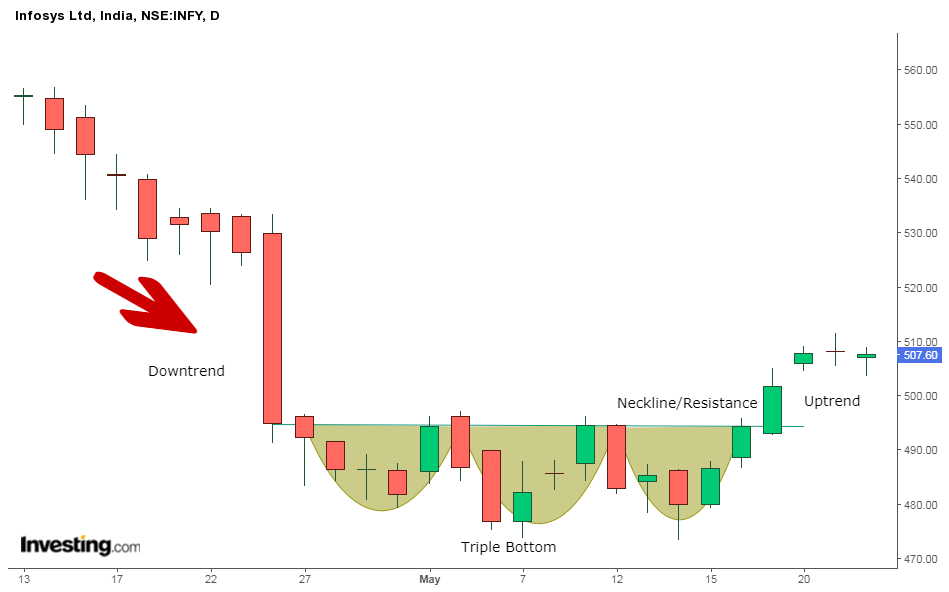

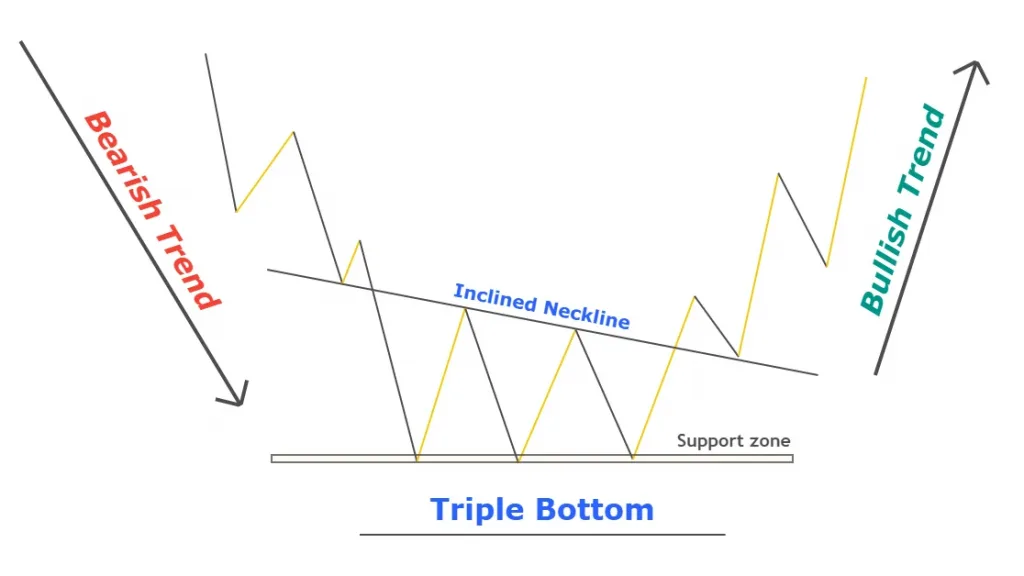

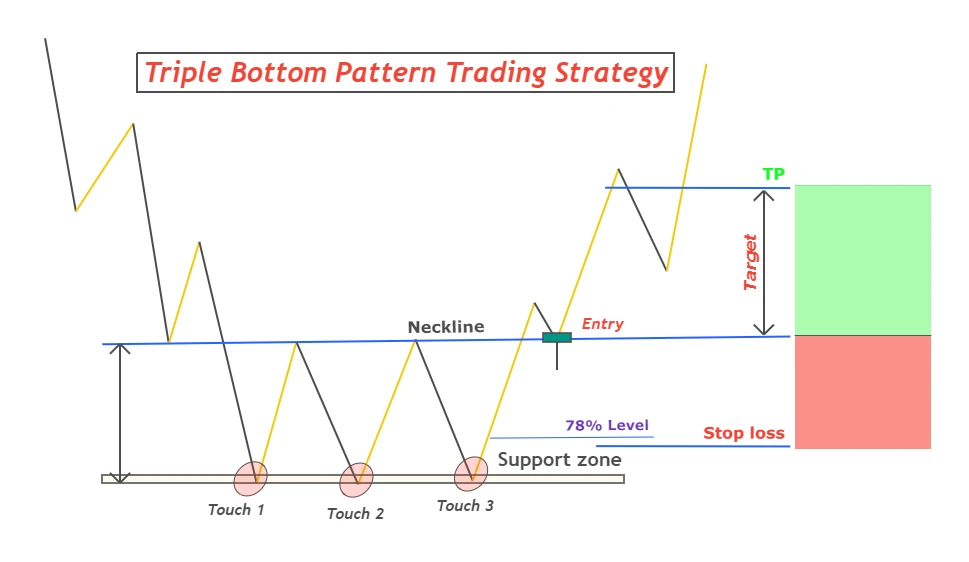

The Triple Bottom Stock Pattern is a chart pattern used in technical analysis thats identified by three equal lows followed by a breakout above the resistance level. The triple bottom pattern is a bullish reversal pattern. The triple bottom pattern a bullish reversal pattern used to predict a bottom in a stock that has tested a support level three.

Triple Bottom - Triple Bottom Pattern A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed. This pattern confirms the continuation of market. A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance.

There are three equal lows followed by a break above resistance. Its created when price bounces off support 3 time at similar levels. Most of the rules that are applied in the formation of the triple top can be reversed in the formation of triple bottom.

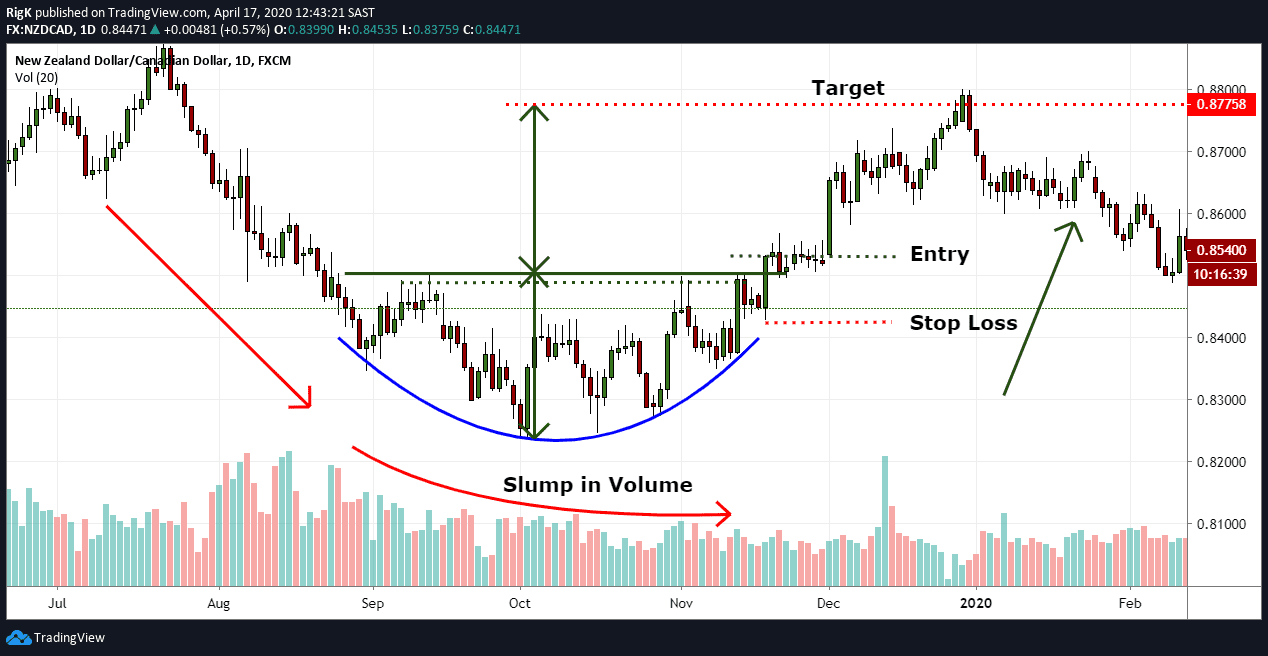

The Triple Bottom stock pattern is a reversal pattern made up of three equal lows followed by a breakout above resistance. Social environmental and financial. As you can see towards the right side of the chart that overhead resistance then became support and propelled the stock higher.

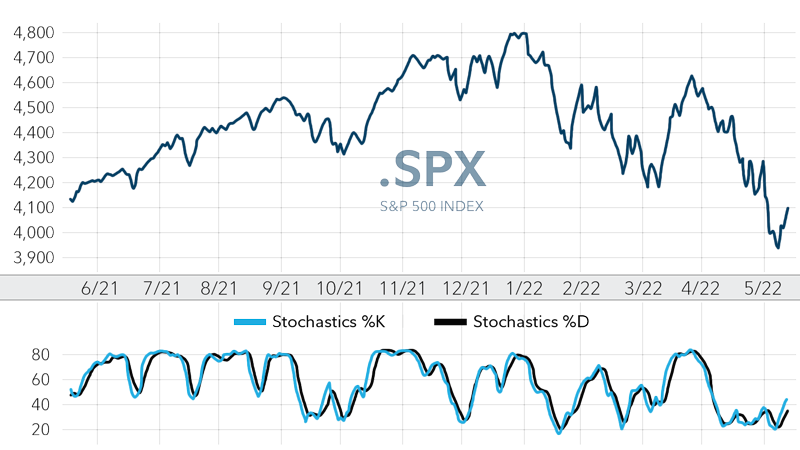

Triple bottom patterns are a bullish pattern. As far as volume is concerned the third low bottom should. The back-to-back huge market rallies last week may seem like a distant memory to investors now that stocks have slid for the past four days.

The triple bottom pattern is important because it is a further indication that the market is moving in one consistent direction. Day Trading Terminology - Warrior Trading. It is an economic concept that includes three aspects in its functioning.

After the first valley is formed price goes up either quickly or gradually. It reflects building up of positive sentiment among market. 54 minutes agoNew York CNN Business.

While this pattern can form over just a few months it is usually a. Triple Bottom Line also known as TBL or 3BL is a transformational framework for businesses to achieve sustainability and financial success. The Triple Bottom Reversal is a bullish reversal pattern typically found on bar charts line charts and candlestick charts.

This approach suggests that there should not be one but three. The Candlestick pattern shows the 3 major support levels of a stock from where it previously.

What Are Triple Bottom Patterns And How To Trade Them

Triple Bottom What The Chart Pattern Means And How To Make Money Using It Business Standard News

Stocks And Stochastics Using Charts And Technical Tools Fidelity

.png)

Bear Markets How To Make Money In A Downward Market

Chart Pattern Screener Triple Bottom From 5 Mins To Monthly Ticks

10 Chart Patterns For Price Action Trading

How To Use Double Top And Double Bottom Chart Patterns Youtube

What Are Triple Bottom Patterns And How To Trade Them

/dotdash_Final_Triple_Bottom_Definition_Jun_2020-01-38534512050d4a0a8e7cefc9ebb3509f.jpg)

What Is A Triple Bottom Chart In Technical Analysis

The Three Most Common Chart Patterns Page 1 Stock News Stock Market Analysis Ibd

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

The Rounding Bottom Pattern Definition Examples 2022

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

Double Top Or Bottom Chart Patterns Education Tradingview

Triple Bottom Reversal Chartschool

The 7 Best Price Action Patterns Ranked By Reliability

How The Triple Bottom Reversal Pattern Works 1 Options Strategies Center